Is Passive Investing Creating a Fragile Market?

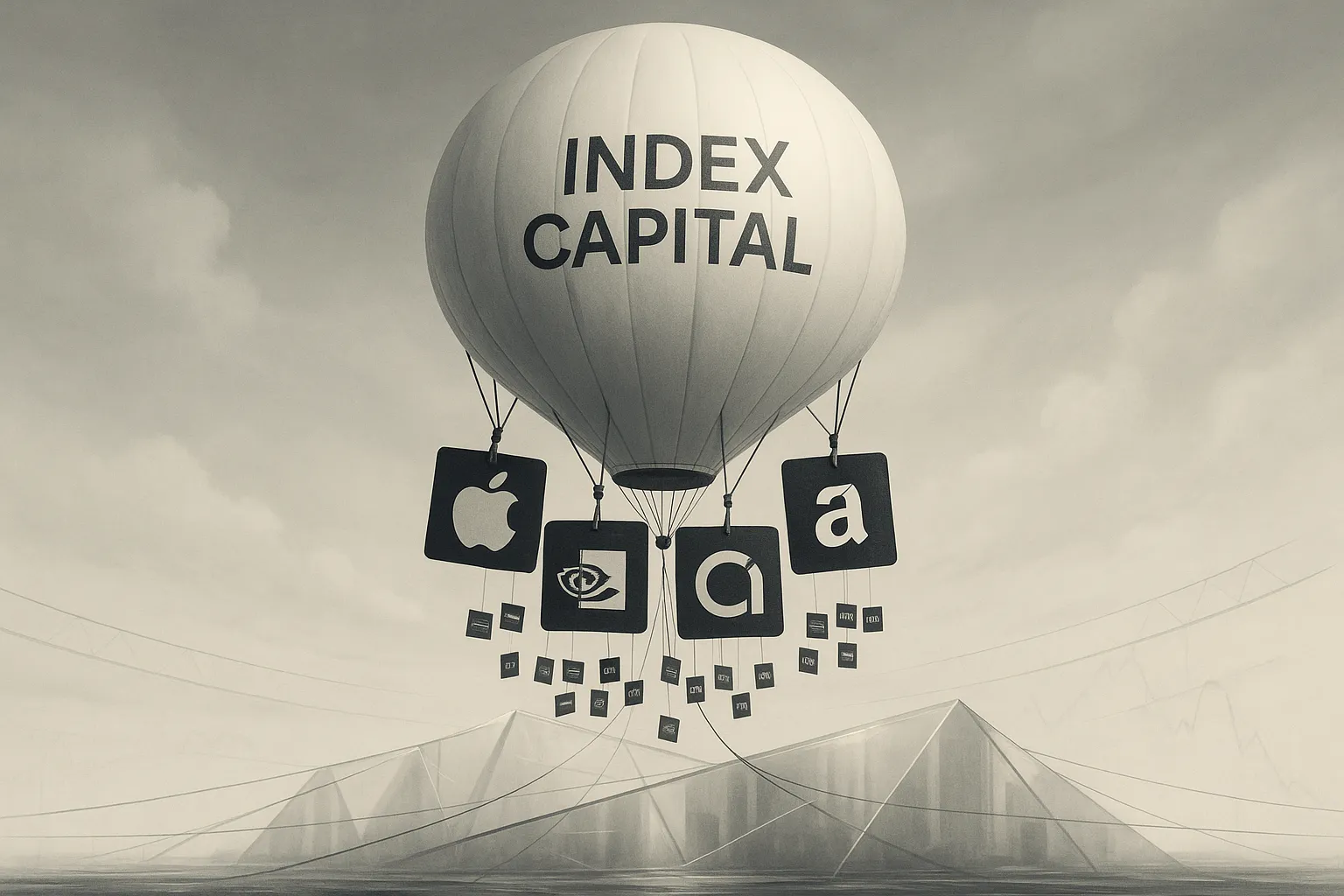

Over the past twenty years, index-based investing has reshaped global markets. By the end of 2023, more than 55% of U.S. equity fund assets were held in passive strategies, according to Morningstar (2023). Many investors view index funds as a low-cost, diversified way to participate in market growth. But as trillions flow into funds that track major benchmarks, a structural concern is emerging: more money is chasing the same group of dominant stocks.

Most major indices are market-cap weighted, meaning the largest companies receive the biggest allocations. When those companies rise in price, they automatically attract more inflows—creating a self-reinforcing cycle. While this reflects investor behavior, not speculation, it raises a deeper question: is passive investing still passive when it systematically reinforces momentum?

Because individual investors don’t pick stocks in index funds, many may not realize how much exposure they have to a small number of names.

Key Takeaways

- Passive flows are concentrating capital into fewer stocks, increasing exposure to systemic risks.

- As of mid-2024, the top 10 S&P 500 companies represented over 37.3% of total index weight—an all-time high.

- Market-cap weighted funds can magnify bubbles by allocating more to stocks that are already richly valued.

- Perceived diversification can be misleading, especially when portfolios hold multiple funds with overlapping top holdings.

- True portfolio diversification requires a closer look at exposures, correlations, and underlying positions.

What If the Leaders Stumble?

Imagine an investor who owns a standard S&P 500 index fund heading into 2022. As of July 16, 2025, just five companies—Nvidia, Microsoft, Apple, Amazon, and Meta—made up 27.1% of the index’s total weight. When technology stocks corrected in 2022, the entire index sank—even though most companies in the benchmark had less severe declines.

This illustrates a key dynamic: broad indices may behave more like concentrated portfolios during periods when leadership narrows. What feels diversified can act very differently under stress.

Efficient Pricing—or Bubble Mechanics?

Some argue that the rise of mega-cap stocks reflects genuine leadership in innovation and earnings. Others see warning signs. A report from the U.S. Treasury’s Office of Financial Research, co-authored by Robert Shiller, highlights how rule-based investment flows can distort prices—even without speculative intent.

This concern echoes the dot-com era, when a handful of tech companies appeared to justify their soaring valuations. Some did. But investor flows eventually outpaced fundamental growth. The result wasn’t just a correction in overvalued names—it triggered a broad downturn due to concentrated exposure.

Today’s passive funds could be setting up a similar pattern—not by chasing returns, but by automatically buying more of what’s already expensive.

Simplicity ≠ Safety

Index investing is attractive for good reason: it offers broad access with minimal cost. But that simplicity may lull some investors into overlooking concentration risk. Common behavioral biases play a role:

- Familiarity bias: Assuming widely known indices are inherently safer

- Recency bias: Overestimating the durability of recent winners

- False diversification: Believing a fund holding 500 companies is always

These assumptions can lead to overconfidence. A person may hold multiple index funds—believing they’re diversified—while being heavily overweight U.S. large-cap growth stocks.

Rethinking Exposure Without Abandoning Passive

Index funds aren’t the problem. But their growing influence means that even diversified investors should periodically recheck exposures. A few simple reviews can help:

- Look at sector and stock overlaps between different funds

- Assess how much of the portfolio is tied to the top S&P names

- Explore equal-weight or factor-based index options for different exposures

These steps don’t require abandoning passive investing. Instead, they help ensure the structure of a portfolio aligns with its intended risk profile.

Sometimes, what seems like broad exposure turns out to be narrower than expected. Understanding what’s under the hood can help avoid surprises—especially when markets shift.